Author

Kai

Published

Reading time

4 min.

Tags

Top 5 European Startups FinTech Innovations and Software

@ChatGPT 4o

Top 5 Most Successful European Startups: A Deep Dive into FinTech and Software Innovation

The European startup ecosystem is booming, and some companies are setting new benchmarks in valuation and market influence. In this article, we explore the top 5 most successful European startups based on their impressive valuations. With a focus on FinTech and software sectors, these companies are revolutionizing digital financial solutions and process optimization. From Revolut's multi-billion euro valuation to Checkout.com's high-caliber payment processing, discover how these innovators are reshaping industries.

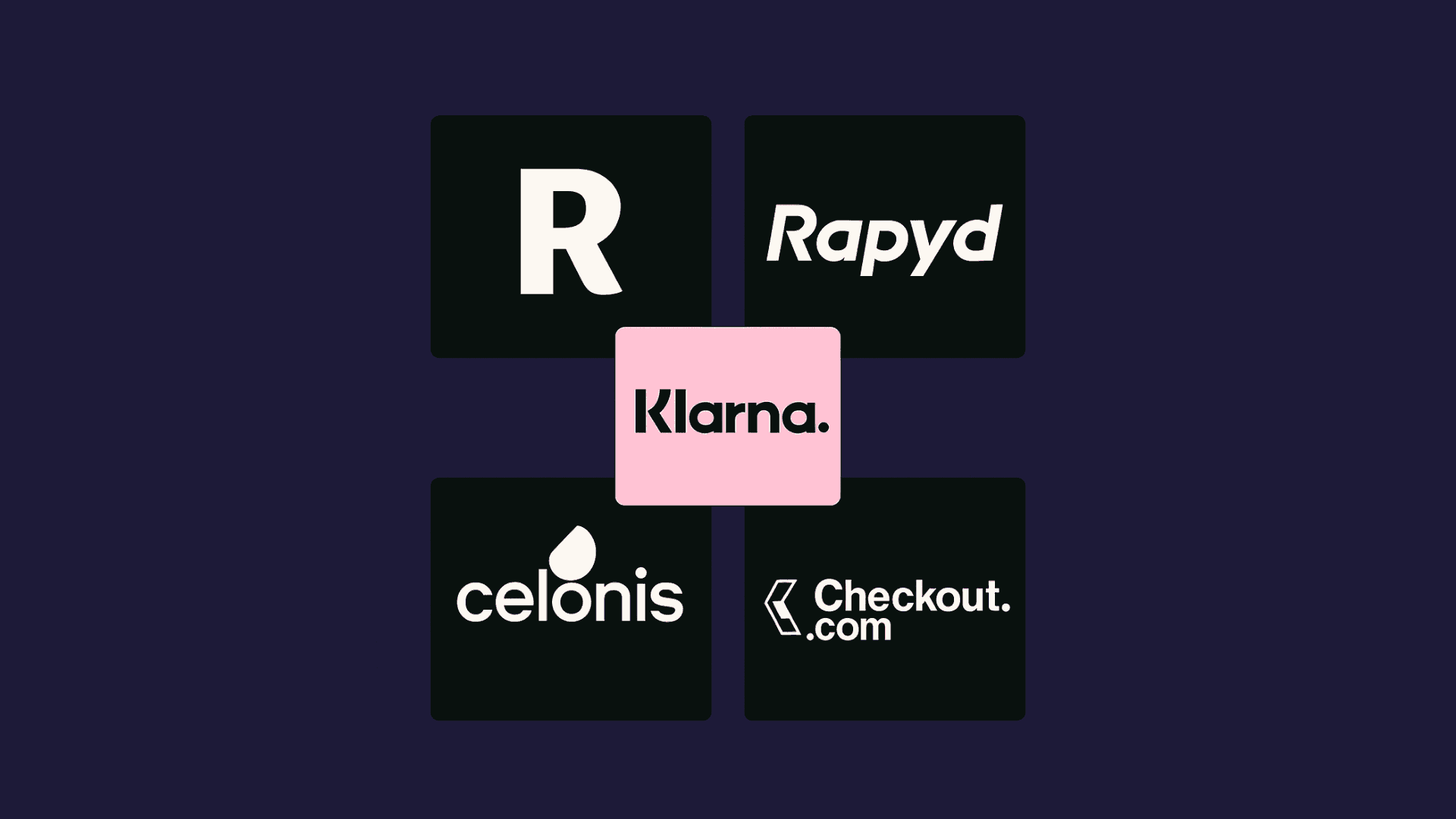

Overview of the Top 5 Startups

Europe has become the breeding ground for groundbreaking startups, particularly within the FinTech domain. Here’s a brief snapshot of our top contenders:

- Revolut: Valued at €43 billion – a leader in digital banking.

- Rapyd: Valued at €14.5 billion – a global payment platform with ongoing debates regarding its European classification.

- Klarna: Valued at €14 billion – renowned for its “Buy Now, Pay Later” solutions.

- Celonis: Valued at €12.5 billion – a pioneer in process mining technology within the software sector.

- Checkout.com: Valued at €9 billion – a specialist in high-performance payment processing.

These companies demonstrate tremendous growth and market presence, underpinning the increasing demand for digital financial solutions across Europe.

In-Depth Company Profiles

Revolut

Overview:

Revolut is a British neobank that has redefined how modern consumers interact with their finances. Through its comprehensive mobile app, Revolut provides services like online banking, money transfers, currency exchange, stock trading, and even insurance.

Key Metrics:

- Valuation: €43 billion

- Customers: Over 45 million (as of June 2024)

History and Success Factors:

Founded in 2015 in London by Nikolay Storonsky and Vlad Yatsenko, Revolut entered the market with a bold vision to democratize financial services. Its rapid ascent can be attributed to its innovative model, aggressive global expansion, and commitment to customer-centric technology. Revolut’s success story is a perfect example of how a clear digital-first strategy can disrupt traditional banking.

Rapyd

Overview:

Rapyd offers a comprehensive payment platform designed to simplify and manage global payments, payouts, and various other financial operations. Its platform provides businesses with a seamless way to handle a multitude of financial transactions across different markets.

Key Metrics:

- Valuation: €14.5 billion

History and Classification Nuances:

Established in 2016, Rapyd’s classification as a European startup has sparked debates. Although some sources list the company as London-based, its actual headquarters is in New York, USA. This ambiguity raises interesting questions about the criteria used to define a “European startup.”

Success Factors:

Rapyd’s focus on innovative payment solutions and seamless integrations across platforms sets it apart, making it a key player in the evolving FinTech landscape.

Klarna

Overview:

Based in Sweden, Klarna has become synonymous with the “Buy Now, Pay Later” trend. The company is pioneering flexible payment solutions that empower consumers while supporting merchants in boosting sales.

Key Metrics:

- Valuation: €14 billion

- Active Consumers: Over 85 million across more than 26 countries

- Merchants: Collaboration with over 575,000 partners worldwide

History and Success Factors:

Founded in 2005 in Stockholm by Sebastian Siemiatkowski, Niklas Adalberth, and Victor Jacobsson, Klarna quickly ascended the FinTech ranks by offering innovative e-commerce payment solutions. Its customer-first approach and continuous product innovation have cemented its position as a leader in digital finance.

Celonis

Overview:

Celonis is a German software company at the forefront of process mining technology. It helps businesses uncover inefficiencies in their operations and streamline processes using its advanced process intelligence platform.

Key Metrics:

- Valuation: €12.5 billion

- Customers: Over 1,350 worldwide

History and Success Factors:

Founded in 2011 in Munich by Alex Rinke, Bastian Nominacher, and Martin Klenk, Celonis pioneered the adoption of process mining in enterprise software. Its ability to deliver actionable insights that drive operational efficiency makes it a standout success in the digital transformation space.

Checkout.com

Overview:

Checkout.com is a British FinTech company specializing in high-performance payment processing solutions. Its platform supports businesses in managing global payments with ease and efficiency.

Key Metrics:

- Valuation: €9 billion

- Global Reach: Processes payments in over 150 currencies

- High-Profile Clients: Companies like Netflix and Pizza Hut rely on Checkout.com

History and Success Factors:

Launched in 2012 in London by Guillaume Pousaz, Checkout.com has carved out a niche by focusing on scalability and reliability in the digital payments landscape. Their strong commitment to innovation has helped them secure an influential spot among the top FinTech companies.

Comparative Analysis

Below is a summarized table for quick reference:

| Company | Valuation (€ bn) | Headquarters | Founded | Core Focus | Founders |

|---|---|---|---|---|---|

| Revolut | 43 | London, UK | 2015 | FinTech (Neobank) | Nikolay Storonsky, Vlad Yatsenko |

| Rapyd | 14.5 | London, UK* | 2016 | FinTech (Payments) | Arik Shtilman |

| Klarna | 14 | Stockholm, Sweden | 2005 | FinTech (Payments) | Sebastian Siemiatkowski, Niklas Adalberth, Victor Jacobsson |

| Celonis | 12.5 | Munich, Germany | 2011 | Software (Process Mining) | Alex Rinke, Bastian Nominacher, Martin Klenk |

| Checkout.com | 9 | London, UK | 2012 | FinTech (Payments) | Guillaume Pousaz |

*Note: Although Rapyd is often cited as London-based, its headquarters in New York spurs ongoing debates about its European affiliation.

Discussion and Uncertainties

The Rapyd Conundrum

One of the interesting challenges in the European startup scene is the ambiguous classification of companies like Rapyd. With its headquarters in New York, questions arise regarding its identity as a European startup. This discussion highlights the complexity of defining geographical boundaries in a global market.

Implications for the FinTech Ecosystem

-

Startups and Market Expansion:

The dominant presence of FinTech startups like Revolut, Klarna, and Checkout.com underscores the sector's rapid expansion and its ability to challenge traditional banking. -

Process Optimization:

Celonis’s success represents the growing importance of software solutions that focus on process mining and optimization, thereby enhancing business efficiencies across various industries. -

Future Trends:

The high valuations of these startups signal continued innovation and robust investor confidence in digital financial solutions. As market boundaries blur, the focus will increasingly shift toward performance, customer experience, and technological adaptability.

Conclusion

The top 5 most successful European startups—Revolut, Rapyd, Klarna, Celonis, and Checkout.com—exemplify the dynamic nature of the modern FinTech and software sectors. These companies, valued between €43 billion and €9 billion, not only highlight the innovation power in Europe but also set the stage for future advancements in digital finance and process optimization.

While debates around the classification of certain companies like Rapyd continue, the overall trend points to a thriving ecosystem where ambition meets technology. As these companies push the envelope in shaping the future of finance and enterprise software, they offer valuable lessons for startups and established firms alike.

Stay updated with the latest trends, and if you’re inspired by the success stories of these dynamic startups, consider exploring more about how digital solutions can transform your business. Join our community for further insights and expert advice on navigating the evolving landscape of FinTech innovation.

FAQ

Q1: What are the main industries in which these startups operate?

The primary industries for these startups are FinTech and software. Most companies, such as Revolut, Klarna, and Checkout.com, are leaders in digital financial solutions, while Celonis stands out as a leader in process mining and process optimization software.

Q2: Why is Rapyd's classification as a European startup under debate?

Although some sources list Rapyd as London-based, the company's headquarters are actually in New York. This discrepancy leads to debates about whether it should be classified as a European startup, highlighting the complexities of global business operations.

Q3: Which startup among these has the highest valuation?

Revolut is the highest valued startup among the group, with a valuation of €43 billion, making it a standout leader in the FinTech sector.

Q4: What factors contribute to these startups' high valuations?

The high valuations are driven by factors such as innovative digital solutions, rapid global expansion, customer-centric service models, and strong investor confidence in the growing markets of FinTech and process optimization.

Q5: How can businesses benefit from the innovations introduced by these startups?

Businesses can leverage the advanced digital financial tools and process optimization techniques offered by these startups to improve efficiency, reduce costs, enhance customer experiences, and stay competitive in a rapidly evolving market.

By understanding the successes and strategies of these top startups, businesses and aspiring entrepreneurs alike can gain valuable insights into thriving in the competitive digital age.

Related Articles

Subscribe to newsletter

Get the latest articles directly in your inbox.